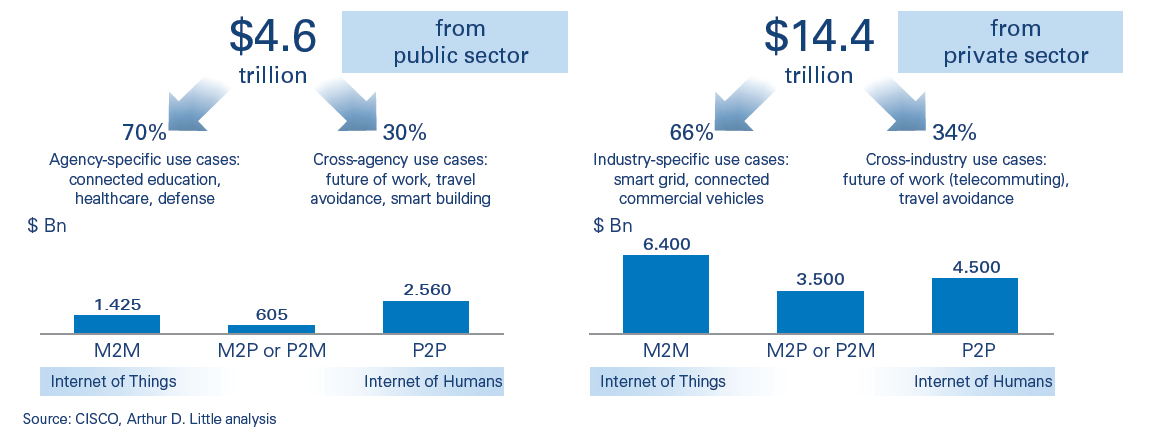

While spending (and revenues) from telecoms service providers are predicted to remain about flat between 2014 and 2019 (see, e.g., Ovum, an independent analyst and consultancy firm), the quest for ultra-high bandwidth in optical backbone networks, whether terrestrial or submarine, seems never ending; this bandwidth need is fueled not only by the development of new applications and new access methods, but also by the advent of new players investing in their own proprietary network infrastructures. According to Cisco, the advent of the Internet of Everything would be associated with a value at stake worth of around $19 trillion by 2022 when combining the value impact from both the public and the private sectors.

The value at stake is defined as the potential value that can be created by public and private sector organizations in terms of lower costs and benefits from greater efficiency.

Telecom is a quickly growing sector within infrastructure. As an increasing number of businesses and individuals turn to the internet and other forms of communication for their needs, telecom becomes as necessary as water or electricity, turning into a basic, vital infrastructure like water distribution network or power grid. This growth in infrastructure, and specifically the telecom industry, is both a direct consequence of economic growth as well as a driving cause of it. Goldman Sachs goes so far as to say that infrastructure “is both a cause and a consequence of economic growth, making it a key aspect [for] long-term projections.”

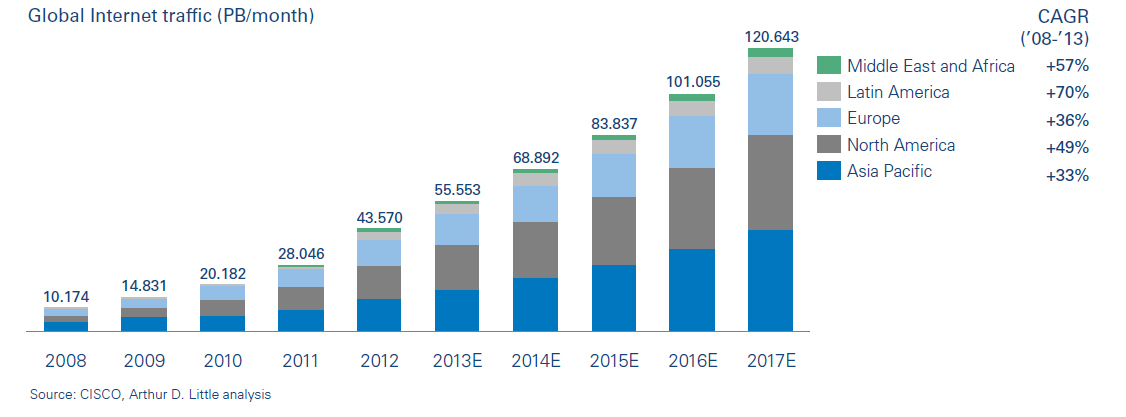

Cisco indicates that IP traffic will continue to grow, but at lower growth rates: highest growth rates are expected from 2013 to 2017 in the Middle East & Africa (35%) and Asia & Pacific (24%).

The exponential demand for bandwidth is fueled not only by increases in the number of users, the access methods and rates, but also the number of services (such as mobile, social media, and video in general) and the increased importance of cloud, cloud services, and data centers. This is already a reality as YouTube and Netflix accumulated in the first half of 2013 50% of total download traffic during the peak time of the US fixed networks, and 30% of that of the mobile networks. At the beginning of 2015, on any given night Netflix and YouTube make up now greater than 50% of US traffic, and 62% of consumers now watch online videos. This evolution is illustrated by the advent of new players whose bandwidth needs are new, are strongly increasing and add to those from traditional telecoms service providers. For instance traffic delivered through Content Delivery Network (CDN) players progressively increased, and accounted in 2014 for about 50% of global Internet traffic.

The same evolution is seen within the data center industry with the development of more proprietary optical long-haul networks dedicated to interconnect data centers with higher capacity, fewer demarcation points, enhanced reliability and lower latency.

For comments or questions, please contact us.